The Best Guide To Medigap

Wiki Article

Excitement About What Is Medigap

Table of ContentsThe Only Guide for How Does Medigap WorksAn Unbiased View of How Does Medigap WorksThe Main Principles Of What Is Medigap The Best Guide To How Does Medigap WorksThe Facts About How Does Medigap Works Revealed

You will need to consult with a qualified Medicare agent for rates and schedule. It is extremely recommended that you buy a Medigap plan during your six-month Medigap open registration duration which starts the month you turn 65 as well as are signed up in Medicare Part B (Medical Insurance Coverage) - medigap. Throughout that time, you can get any type of Medigap plan sold in your state, even if you have pre-existing problems.You might have to get a much more costly plan later, or you might not be able to acquire a Medigap plan whatsoever. There is no guarantee an insurer will sell you Medigap if you look for insurance coverage outside your open enrollment duration. As soon as you have determined which Medigap strategy satisfies your demands, it's time to figure out which insurance provider market Medigap policies in your state.

Likewise called Medicare Supplement, Medigap insurance coverage intends assistance fill out the "voids" in Original Medicare by covering a portion of the out-of-pocket prices left over after Medicare Component A and B protection. The exact protections depend upon the type of plan that is bought and which specify you reside in.

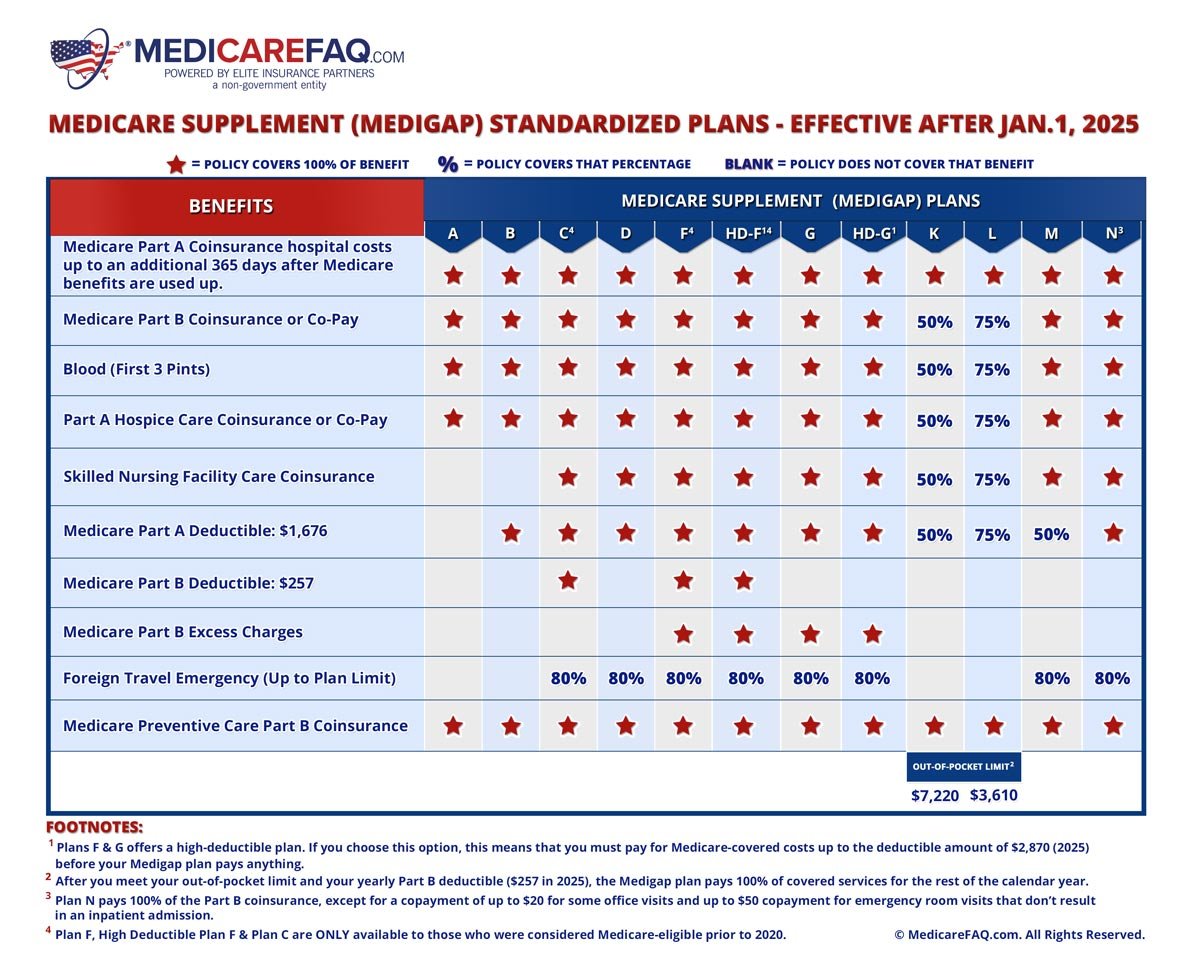

In general, Medigap insurance companies deal with Original Medicare as well as each plan type supplies the exact same benefits, even across insurers. In many states, Medicare supplement strategies are called A through N. Table of Component, Expand, Collapse When checking out Medigap prepares, you may likewise check out Medicare Advantage prepares Called Medicare Part C.

Medicare supplement insurance, insurance coverage the other hand, is an addition to enhancement existing Original Medicare plan. Medigap policies only can be integrated with Initial Medicare and not Medicare Advantage. Medigap plans are standard as well as determined by letters, as well as have to adhere to government as well as state standards. Typical Medigap protections consist of: This is an out-of-pocket expense that individuals have to pay each time they receive healthcare or a clinical thing, such as a prescription.

This is the percent of the price of a solution that you show to Medicare. Medigap benefits. With Component B, Medicare normally pays 80% and also the client pays 20%. This is the amount of money the person have to pay out of pocket for medical care before Medicare starts paying for the costs. With Part medigap A, there's an insurance deductible that relates to each advantage duration for inpatient treatment in a hospital setup.

Unknown Facts About How Does Medigap Works

, private-duty nursing, or long-term care.

Medigap prepares might aid you minimize your out-of-pocket medical care expenditures so you can obtain cost effective treatment for thorough medical care throughout your retirement years. Medicare supplement strategies might not be right for each scenario, but recognizing your choices will help you decide whether this sort of protection can aid you handle healthcare prices.

Journalist Philip Moeller is below to supply the solutions you need on aging as well as retired life. His weekly column, "Ask Phil," intends to aid older Americans and also their family members by answering their health and wellness treatment as well as economic questions.

The Ultimate Guide To Medigap Benefits

The biggest void is that Part B of Medicare pays only 80 percent of protected costs. More than likely, more individuals would purchase Medigap strategies if they can pay for the monthly premiums. Nearly two-thirds of Medicare enrollees have fundamental Medicare, with concerning 35 percent of enrollees instead choosing Medicare Benefit strategies.

Unlike other exclusive Medicare insurance coverage plans, Medigap plans are regulated by the states. As well as while the certain insurance coverage in the 11 different kinds of plans are determined by government regulations, the costs and availability of the plans rely on state regulations. Federal policies do give guaranteed issue civil liberties for Medigap buyers when they are brand-new to Medicare and also in some situations when they change between Medicare Benefit and basic Medicare.

Once the six-month period of federally mandated civil liberties has actually passed, state guidelines take over identifying the legal rights individuals have if they desire to purchase brand-new Medigap plans. Right here, the Kaiser table of state-by-state regulations is indispensable. It ought to be a compulsory stop for any person considering the duty of Medigap in their Medicare plans.

How Medigap Benefits can Save You Time, Stress, and Money.

I have not seen tough information on such conversion experiences, as well as on a regular basis inform readers to check the marketplace for new plans in their state before they change into or out of a Medigap plan during open registration. I believe that anxiety of a feasible problem makes lots of Medigap insurance holders resistant to alter.A Medicare Select policy is a Medicare Supplement plan (Strategy A with N) that conditions the repayment of benefits, in entire or in part, on the usage of network companies. Network service providers are service providers of healthcare which have actually become part of a written agreement with an insurance company to offer benefits under a Medicare Select plan.

Report this wiki page